Lessons Learned from Opportunity EduFinance’s Student Financing Pilot for India’s TVET Sector

In India, hundreds of thousands of young people aspire to upskill through short, job-oriented technical and vocational education and training (TVET) courses, yet for many, finance remains a barrier. Beginning in 2022, Opportunity EduFinance launched a student loan financing pilot program tailored to the needs of vocational learners. Now, three years later, Opportunity shares key challenges and lessons learned that are critical to implementing an effective TVET loan program and meeting the needs of underserved youth.

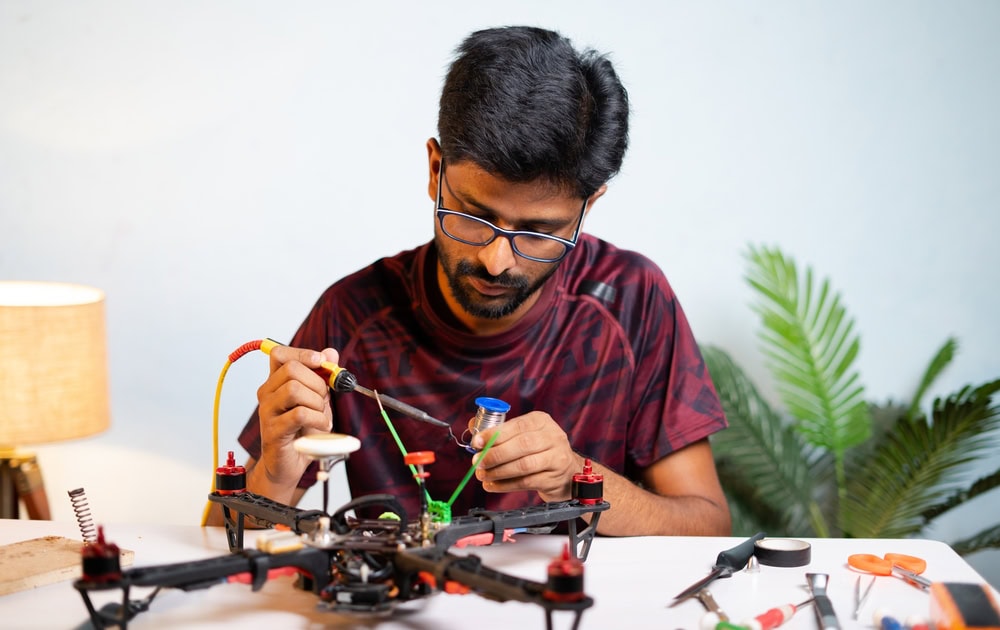

The Stakes: Youth Unemployment, Skills Gaps, and the Underfunding of TVET

Globally, in 2022 according to UNESCO, the average youth unemployment rate was about 16%, roughly three times the adult rate in many countries. In low- and middle-income countries, TVET is widely regarded as a vital pathway to equip young people with employable skills, but it is chronically underfunded. A World Bank analysis notes that the share of government spending devoted to TVET varies dramatically, from nearly zero to as high as 15% of total education budgets. Many countries lean heavily on general education and tertiary funding, leaving TVET underprioritized.

Youth unemployment remains a persistent challenge in India. According to World Bank data, the youth unemployment rate (ages 15–24) is estimated at 16.03% as of recent figures. For women, this number is slightly higher at 17.6% of female youth are unemployed and is a particular challenge in urban areas according to a recent report. Moreover, youth who do receive jobs are often under-employed, locked into informal or low-pay work despite high educational qualifications. This challenge is again exacerbated in urban areas, with a recent report showing rates of underemployment was more prevalent in urban areas (at 8.4%) than in rural areas (at 7.2%).

In recent years in India, the TVET landscape has evolved rapidly through a series of major national initiatives aimed at expanding skills training, industry alignment, and inclusion. Initiatives such as the Skill India Mission, or the National Apprenticeship Promotion Scheme, highlighted the Government of India’s plans to develop a well-functioning TVET system as a strategy to achieving economic growth, and announced skills development as a key national priority. This was further supported by the launch of the State of the Education Report for India 2020: Technical and Vocational Education and Training (TVET) by UNESCO alongside other initiatives.

However, despite a strong national focus on TVET, funding flows specifically targeted at youth-skilling or TVET-loan models remain scarce. The tendency is for public subsidies, employer-subsidized training, and public TVET institutions to dominate, with little space for student-directed credit. In many contexts, the mismatch between short-duration vocational courses and conventional educational loan products leaves a blind spot in the young learner-to-employment pipeline.

Why Financing is a Key Barrier for Youth in TVET

The financing hurdle for vocational learners has multiple dimensions:

- Upfront cost burden: Many TVET courses require full or substantial fee payments at enrollment, which many students from low-income backgrounds cannot afford.

- Lack of credit history and risk profile: Many youth come from households with minimal formal credit exposure and are deemed high-risk.

- Shorter course duration & uncertain cashflow: Because vocational training programs are often short (lasting only a few months rather than several years), students may not have stable or predictable income immediately after completing their studies. This irregular pattern of income and expenses, known as cashflow, makes it difficult for financial institutions to design appropriate repayment schedules (the planned timeline and amount for loan repayments). As a result, lenders struggle to align repayment timelines with when graduates begin earning consistently.

- Perceived employability uncertainty: financial institutions may lack confidence about the job outcomes of courses or institutions, and hesitant to finance them.

- Fragmented training ecosystem: Without strong coordination between training providers, placement agencies, and financial institutions, the risks (e.g. dropout, low placement) are higher.

In India, technical and vocational education and training (TVET) is essential to bridging the education-to-employment gap, particularly for youth excluded from higher education due to financial barriers and unequal access. In 2024, only 28.4% of young people aged 18–23 were enrolled in tertiary institutions, leaving the majority of India’s youth outside the formal university system due to financial barriers, limited institutional capacity, and regional inequalities in access. Even among university graduates, joblessness remains high, as traditional higher education often fails to provide market-relevant and transferable skills. When youth are blocked from training due to financing, the economy loses twice: first, by leaving potential skills unused; second, by permitting larger youth cohorts to stagnate unemployed or in low-productivity jobs.

Five Lessons from Opportunity EduFinance’s TVET Loan Financing Model

In India, many students pursuing TVET programs face difficulty covering short-term but intensive course costs, as they are often ineligible for traditional education loans designed for longer university degrees. Skill loans are specialized financial products that provide short-duration credit to help students pay for vocational training, typically with flexible repayment terms that begin once the student secures employment. These loans differ from conventional higher-education or consumer loans by focusing on smaller loan sizes, shorter repayment cycles, and alignment with expected post-training income streams.

Against this backdrop, in 2022, Opportunity EduFinance piloted an innovative skill loan financing model for TVET students in India. The pilot engaged financial institutions and provided technical assistance to co-create customized skill loan products to meet student financing needs, calibrate repayment schedules, and manage portfolio risk. The pilot worked within the existing TVET ecosystem to vet training centers and assess employability prospects, while also engaging with government partners to provide subsidized loans to financial institutions for on-lending to students. On-lending refers to the practice where a financial institution or intermediary receives funds at a subsidized rate from a government agency, development bank, or donor, and then lends those funds onward to end borrowers, such as students. In this pilot, government partners provided low-cost capital to participating financial institutions, which then on-lend the funds to students as skill loans.

Early results of the pilot captured in a midline evaluation in 2023 indicated some initial successes, with several challenges still remaining. While lending processes are meeting student demand, with 94% of surveyed students describing the process of applying for a loan as ‘easy’ or ‘extremely easy’, challenges remain in achieving long-term employment outcomes for loan recipients. Now, three years since the launch of the pilot initiative, Opportunity EduFinance has identified five key success factors for scaling future TVET loan programs, offering valuable lessons for countries seeking to expand access to vocational education training for low-income students.

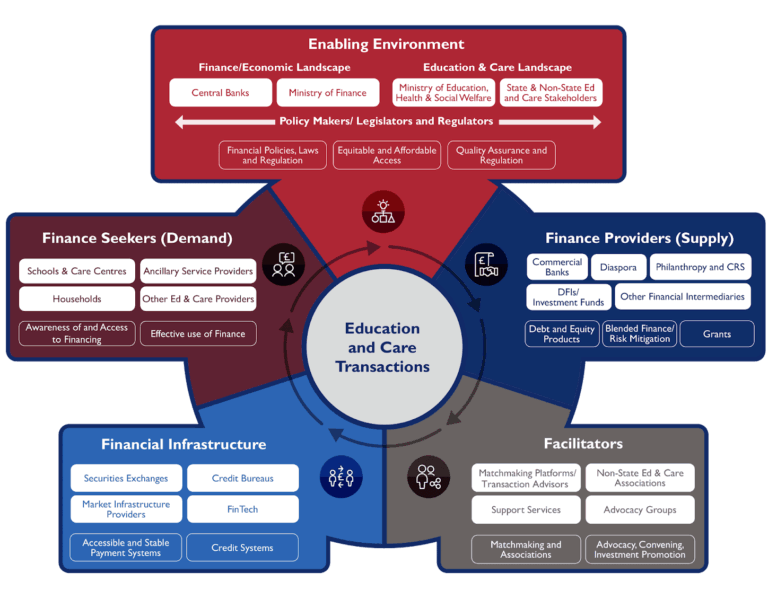

- Collaboration is the cornerstone of success. Skill loan programs thrive when multiple stakeholders work together as enablers. Government agencies can strengthen credit guarantee frameworks, Development Finance Institutions (DFIs) can ensure liquidity for financial institutions, and technical assistance partners such as Opportunity International can guide new lenders entering the space. Alongside this, support for students is key: financial institutions can build financial literacy for students who are first-time borrowers, and accreditation agencies must uphold quality assurance in training delivery. When all these pieces work together, the system becomes both inclusive and resilient.

- Transparency matters more than job promises. Courses offering job assurances or stipends often experience higher defaults. A key challenge arose during the pilot program when promised placements did not materialize, and students were left unable, or unwilling, to repay. Clear, transparent communication about employment outcomes is essential for student borrowers and lenders alike. Partnerships with accreditation agencies that can underwrite training institutes can also reduce uncertainty and give financial institutions confidence in their partners.

- Employers are the missing link in the value chain. Employers drive skill demand and can also de-risk lending. Including employers in the loan journey, such as through salary deduction mechanisms post-placement, offers lenders repayment assurance and strengthens alignment between training supply and labor market needs. This approach helps address a key challenge observed during the pilot, where weak linkages between training providers, employers, and lenders made it difficult to ensure consistent employment outcomes and reliable loan repayment.

- Loan terms and repayment structures should match learners’ realities. Designing repayment schedules that are realistic and student-friendly allows students time and space to repay. This may mean extending loan tenures beyond course completion so students can achieve income stability before repayments begin. This design approach promotes repayment discipline and long-term financial inclusion. Further, ensuring loan terms are clear and transparent, alongside targeted training in financial literacy, can help first-time borrowers understand the credit fundamentals to borrow responsibly. This helps address challenges identified during the pilot, where short repayment timelines and limited borrower understanding of loan terms created high risk of default among graduates.

- Shared risk ensures shared accountability. Models where training institutes provide a first-loss default guarantee have proven effective. This arrangement ensures that institutes have a stake in the learner’s success, incentivizing them to minimize dropouts, maintain training quality, and support students through completion and employment. Alongside this, introducing other sources of capital such as philanthropic capital into the ecosystem can unlock private investment by absorbing early-stage risks. Such capital can be strategically used for underwriting training institutes, funding financial literacy programs, and subsidizing interest rates to make loans more affordable for students.

Looking Forward

In India, sectors such as manufacturing, construction, logistics and retail, which collectively absorb large numbers of workers and are projected to grow significantly, stand to benefit directly from a more skilled workforce. For example, investment in formal skilling is estimated to boost employment in labour-intensive sectors by over 13% by 2030. Leveraging youth workforce potential is thus critical to ensuring long-term economic growth in India. As youth unemployment rises in India and globally, the need for TVET financing at scale is greater than ever. Scaling the model will depend on more capital, stronger regulatory support for training centres, and strengthened financial literacy for student borrowers. Moreover, robust tracking of employment outcomes and repayment performance will be critical to prove sustainability.

Based on lessons learned from the pilot program, Opportunity EduFinance plans to continue this work in other contexts such as Kenya and tackle similar challenges through intentional partnerships and a unified approach. Underpinning all of this is the key lesson that building a scalable and sustainable TVET financing model requires not just innovative loan products but also an ecosystem that enables collaboration, accountability, and learner protection. Especially in contexts where vocational learners are underserved by traditional credit, the pathway to dignified, gainful employment depends not just on skills, but on access to finance.

Student loans are not a new concept. While financing options exist for tertiary education, similar mechanisms are often unavailable for short-term, practical, and technical courses, even though developing economies urgently need such skillsets. Opportunity’s goal is to explore how student loan models can be adapted to support TVET financing, allowing financial institutions to build sustainable lending portfolios that contribute to long-term economic growth, while enabling students to borrow safely and confidently for their futures.

This blog was co-authored by Natalie Davirro, MERL Lead at Opportunity International EduFinance, and the Education Finance Network (EFN).